Expressions of Frustration with recent Texas Legislature sessions

Colleyville, Texas -November 28, 2017

It seems to be a common occurrence in today’s political climate…a lot of frustration with the legislative process. On Monday evening, Nov. 27, 2017 the Colleyville Republican Club invited 5 to participate in a scenario of what happened the last regular and then, Special Session called by Governor Abbott.

The five speakers invited were; Gio Capriglione, the current State House Representative from HD 98, (he failed to make an appearance); those appearing were, Armin, Mizani, GOP Primary Challenger of Capriglione, Konni Burton, State Senator Dist. 10, resident of Colleyville, Mayor Richard Newton of Colleyville and Ross Kecseg, who leads the Metroplex Bureau of Empower Texans.

Speakers left to right; Colleyville Mayor Richard Newton, Ross Kecseg, Empower Texans, State Senator Konni Burton, Dist. 10,

Armin Mizani, Keller Councilman and Candidate for Texas State House District 98

Kecseg was the first speaker and relayed a remarkable statistic that current the State of Texas is the second highest state in local public debt, only New York is higher. Regarding Texas,

Kecseg pointed out that voters are allowed to vote on all tax increases EXCEPT School Taxes. Further, School Bond issues are repaid from local property Taxes. The School District is not required to reveal to voters the impact the Bond issue will have on local taxes.

Kesceg pointed out the Texas State Senate came to agreement on a number of taxing entities and resolutions, however the House, then led by Joe Strauss would not agree and in the special session called by the Governor, time ran out to pass any meaningful tax reform.

The only solution, according to Kesceg, is should the public demand real reform in School Finances; then limit state spending growth, buy down the Robin Hood debt until it replaces 40% to 50% of School taxes. He pointed out it should be noted that with GCISD rate hikes, as well as, 8% on top of appraisal growth is all borrowed money, NO MONEY CAN BE USED TO PAY TEACHERS!

Kesceg pointed out that nothing should be on the ballot without disclosing what the actual tax impact will be on the public; however, school districts continue to oppose this basic information to taxpayers.

She said there was some hope in the Special Session, except one GOP Senator wanted to raise the exemption to $20,000,000 school districts, therefore none of these residents would virtually ever be able to gain property tax relief..once again the Texas Legislature, especially the House under the Previous Speaker Joe Strauss, failed to pass legislation to hold school districts accountable on the ballot. The impact of Robin Hood on the GCISD taxpayer? In addition, to millions of dollars ask to be approved for items like an indoor practice facility, none of the funds are available for teacher pay.

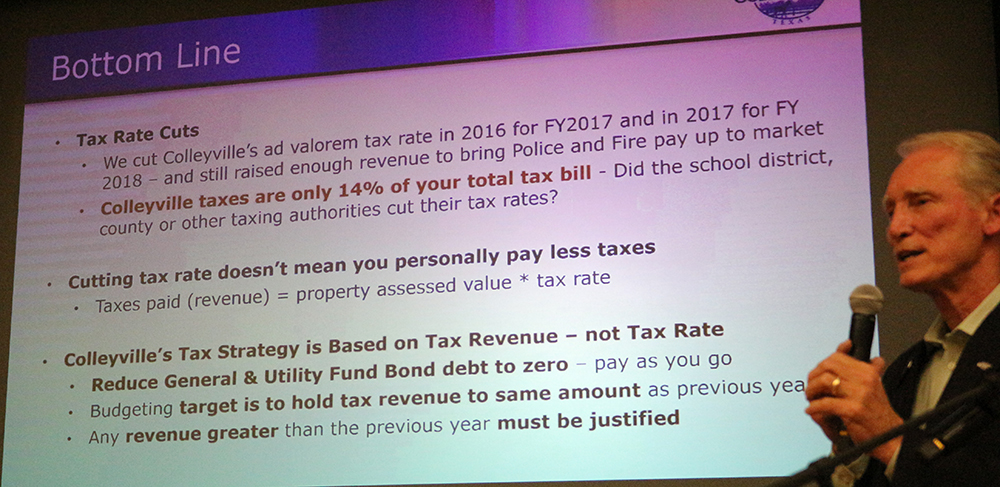

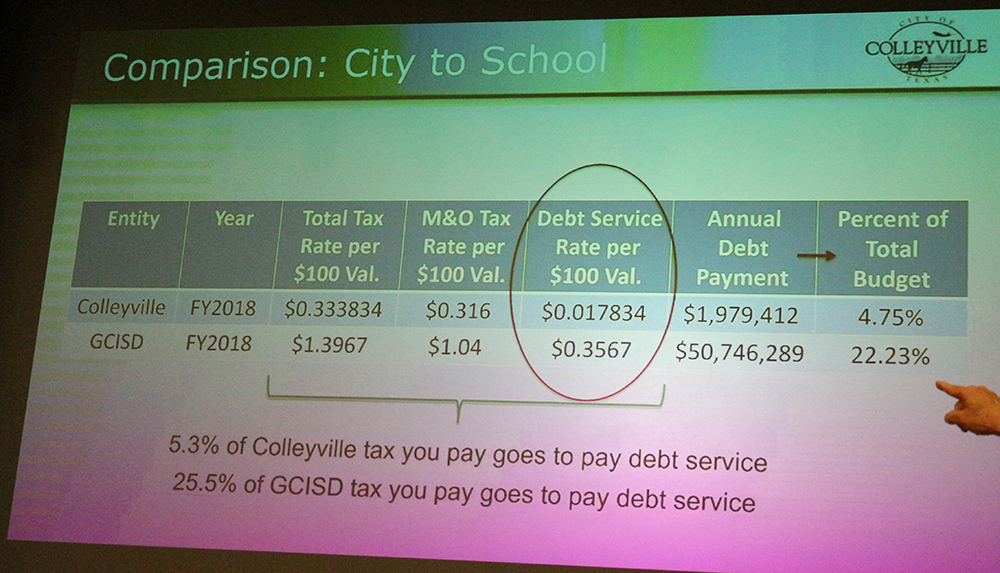

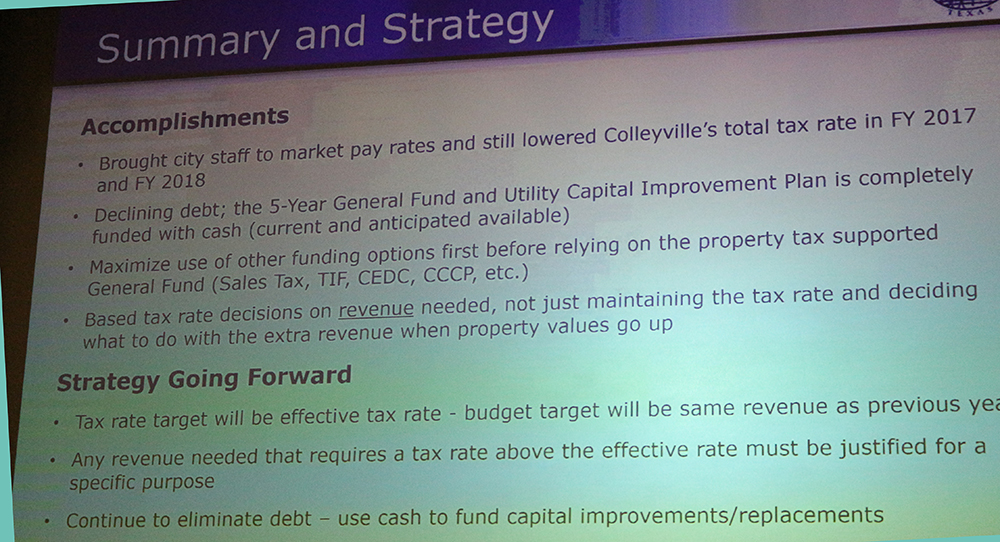

“Gio Capriglione has been very neglectful, his 6 years in office; when running he promised to put an end to Robin Hood and address taxes, instead the GCISD taxpayers sent $44,000,000 to Austin this year alone with Robin Hood snatching $29,000,000 of these funds. He pointed out the Texas Supreme Court ruled the legislature needed to fix the unsustainable Robin Hood plan, but to no avail to date. Mizani, further pointed out, “In the 3 terms that Capriglione has served he has betrayed taxpayer, with his conservative spending score of 98% tear one, 74% year two, and 63% this past session.” Plain and simple property taxes are pricing people out of their homes, Mizani pointed out. The following slides were presented by Mayor Newton; Mayor Newton points out the significant amount of 25.5% of GCISD taxes go to pay debt service and only 5.3% of the City of Colleyville.

Mayor Newton points out the City’s cut to ad valorem tax rate for FY2017 and FY 2018.

One Comment

Michael T. Muhm

I applaud the forum and discussion and would hope that maybe it will lead to leadership on this important issue. It really is sad that seemingly the Texas House and Senate is incapable of providing relief for Texas taxpayers, i.e. can’t provide a “reasonable” cap on property tax appraisal increases, currently at 10%. A 4% or 5% cap would seemingly be acceptable to taxpayers AND still provide an ample supply of revenue (aka taxes) for local, school, county and state budgets to be funded. Heck, maybe these entities might even have to manage their budgets closer and really try to live a bit more on what they are given, vs. having too much money to be spent on grandeous “wants” instead of the “needs”. Honestly, if the current slate of elected folks can’t make this happen (as they were unable to in the last session) is it certainly a time for personnel changes and “fire” them at the ballot box a the next opportunity. The time to tackle the “real” issues effecting Texans is here and now…..Maybe less time can be spent on social issues (bathroom bill) and more time and effort on the pocketbook issues effecting Texas families.