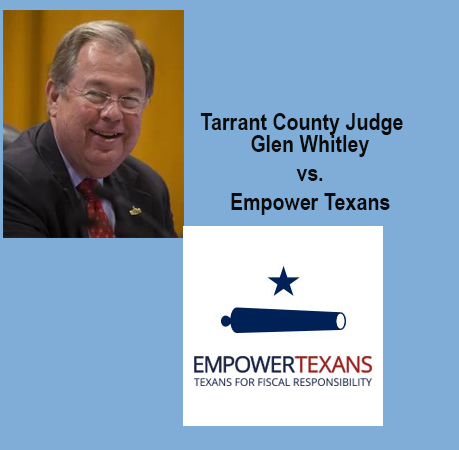

Colleyville, Texas March 13, 2019

Editor’s Note: First Below is the following note, sent by Editor Nelson Thibodeaux to ask Judge Whitley, “if he wanted to amend his retort, so as not to be attacking the conservative Empower Texans.”

Judge Whitley responded with “Please post the response. Glen”..March 13, 2019.

1.) First is Editor Nelson Thibodeaux’s response to Judge Whitley’s original response to the original article from Robert Montoya of Empower Texans

2.) Is the Original Article by Robert Montoya of Empower Texans.

“March 12, 2019

Judge Whitley:

Frankly, I thought your response would be on target with the challenges concerning the substance of the matter, not an attack on Empower Texans.

The attack on Empower Texans, as a group, that has destroyed “bi-partisan” politics in Texas, in my opinion is totally off the mark. Their primary goal is to respond to the continual challenge from the liberal Democrats, such as the invasion of Beto money that flowed into the state this past election.

Further, I see the liberal influence, even in local Colleyville politics, simply by observing the supporters opposing side to Mayor Newton, as primarily active admirers of Beto.

Fact of the matter, concerning property taxes, I have seen mine continue to rise in Tarrant County, I have seen a school board build a $28 million football stadium, rather than use this TIF money to retire a dime of the more than $60 million in debt. This was free money to the district and changed a $1 million repair to a $28 million edifice to the school board.

In 20 years and more than one million visits to LNO, I never considered LNO as a news source that took an active opposition to you, Tom Wilder, Gary Fickes, etc. I always considered this group to come from the conservative side of local, county and state races.

As full disclosure, I was awarded the Empower Texans sword in 2018, for being a continual source of conservative principles for two decades in Northeast Tarrant County.

I wrote editorials concerning the attempt to dislodge a Muslim from the Tarrant County Party apparatus, as you and the others did.

However, once again, my goal was to give you an opportunity to challenge the facts as stated in the article, not to attack Empower Texans.

This is a grievous miscalculation on your part and the publication of your response is very likely to arouse a large group of conservatives in this area, including office holders and their supporters at multiple levels.

Therefore, as Editor of LNO, I have made the decision not to publish your response; at this time and provided my reasons.

However, if you have made a decision, this is actually the type of attack article on Empower Texans you want published, then upon your confirmation, I will post the response.

Nelson”

Judge Whitley responded with “Please post the response. Glen”..March 13, 2019, to the following opinion piece.

Local Official: We’re Not Spending Too Much

by Robert Montoya, Empower Texans

Tarrant County Judge Glen Whitley recently doubled down against property tax reform and argued not only that taxes are not too high, but that the government needs to spend even more.

At the Texas House Ways and Means Committee hearing on House Bill 2, Whitley argued against a newly proposed property tax reform that would give citizens more power over their own money.

HB 2 is quite straightforward: Should a local government want to raise taxes more than 2.5 percent in a year, it would simply have to ask voters for approval first.

Whitley is staunchly against such an idea and even refused to acknowledge that taxpayers across the state are being hurt at all by soaring taxes.

“Texas, when compared to other states with regards to total state and local revenues, is 29th on a per person basis and 37th on a percentage of personal income basis,” Whitley told the committee. “We’re in the bottom half of both [of] those categories.”

Whitley’s statement completely ignores data from the Tarrant County Appraisal District, which shows that taxpayers in his own backyard are facing hefty property tax bills that only keep getting heavier. In Tarrant County alone, the average of the county’s portion of homeowners’ property tax bill increased 31 percent over a five year period.

And that’s just the county government; that doesn’t include the school district or city portions of the property tax bill that Tarrant County homeowners also have to pay. Over the same time frame, for example, the portion of the average property tax bill for the Fort Worth Independent School District increased by 42 percent, Birdville ISD’s by 46.4 percent, the city of Fort Worth’s by 36.3 percent, and the city of Arlington’s by 40.3 percent.

Instead of acknowledging the out-of-control taxes, Whitley played the shell game most local elected officials play: pointing fingers at the appraisal districts for rising property tax bills, an oft-used flimsy tactic that tries to deceive taxpayers into thinking local officials don’t have control over their own tax rates. Officials such as Whitley can still lower taxes regardless of what home values are.

He also argued that exemptions for property taxpayers cost local governments money and that Austin’s priority should not be the burdens faced by property taxpayers, but the financial needs of local government.

“If you want to pass a property tax exemption, then all I ask is that you send us the money for whatever exemption; and there are some great exemptions out there. But if we’re going to do that, then let’s look at it from that perspective.”

The county judge’s final point was perhaps the most shocking.

“I don’t think we’re spending too much money,” he said.

As previously reported by Texas Scorecard, Whitley has burnt at least $24 million of Tarrant County taxpayers’ money on a failed software program that still doesn’t work and even drew in Dallas County to join the boondoggle, costing taxpayers in both counties at least $69 million on his failed software projects by 2017.

But according to Whitley, citizens should not have the opportunity to have more control over their own money—simply electing officials should be the limit of citizens’ power.

“[Voters] give us feedback every two to four years when there are elections,” he said.

A recent poll by Quinnipiac showed that an overwhelming 77 percent of Texans support having a say over any property tax increases above 2.5 percent. Despite that, comments from local officials such as Whitley clearly demonstrate they are not concerned with giving Texans more control over their own money.

“We’re going to have to spend more money to keep the Texas miracle alive,” Whitley told the committee.

Taxpayers should tell Whitley, and their elected representatives in Austin, that the miracle needed now is for citizens to keep more of their own money.

The following is the original response of Tarrant County Judge Glen Whitley****************************************************************************

Texas Scorecard is a publication of Empower Texans, an organization which began in 2006 and has continued to promote their ideologies ever since. They and their financial backers have spent millions of dollars getting Texas legislators elected and then using their influence to tell them how to vote. Go against their recommendations, and they recruit someone to run against you. I feel they and their followers have done more than any other organization to diminish the bipartisan spirit which thrived in our state capitol before 2006. So, as I respond to the Texas Scorecard article, please understand I am really responding to Empower Texans.

Empower Texans has been deliberate in their efforts to convince Texans property tax increases have been skyrocketing and local elected officials are to blame. They deliberately present data which shows big percentage increases or big dollar increase in total tax levies. Taking this at face value, it looks like local government is running away with your money, right? However, when you look at the same data on a per person basis which takes population growth into account, we see quite a different picture emerge, a picture which doesn’t fit their narrative. Here is how Tarrant County has fared over the 10 years I have served as Tarrant County Judge, a place Senator Paul Bettencourt calls “the garden spot.”

Total Taxes Taxes Collected

Collected per Capita

2008 $303,015,955 $170.22

2013 $327,324,364 $176.08

2018 $406,075,309 $197.32

The percentage increase from 2008 to 2018 for total taxes collected was 34%. Total dollars collected increased by $103,059,354. Sounds big right? But over the same 10-year period, the annual taxes collected per person only increased by only $27.10. That is $2.71 per person per year more. Doesn’t sound so big now does it?

In my testimony before the House Way and Means committee, I did say we needed to spend more money on public education. I would like to point out that all three state leaders have agreed with this notion and both chambers have proposed spending an additional $9 billion dollars during the next biennium. Why? Because 41 states spend more than us and most of those other states out-perform us as well. And yes, I do feel we need to spend more money on roads given that by 2036, Texas’ bicentennial, our estimated population will be 41 million people. Texas is nowhere close to being prepared to support that level of demand for infrastructure.

It is important to take a step back and look at the total state and local tax burden and how that burden is applied (property, sales, income taxes) to better understand just where Texas ranks across the nation. Overall, the Tax Foundation ranks Texas 29th on dollars collected per person and the Tax Policy Foundation at Brookings ranked Texas 37th when you compare dollars collected as a percentage of personal income. We are in the bottom half of both categories. As far as how the burden is applied, Texas has chosen to rely on sales and property tax to fund most state and local government. We thankfully do not, and I pray never will, have a state income tax.

There has been a lot of discussion regarding voting on annual budgets if they increase over 2.5%. I hope we remain a representative form of government and not a referendum form of government. I elect folks who will represent me and vote to spend my tax money like it was their own. I want them to provide the essentials, public safety, public health, and good roads. I also want them to provide those things which improve the quality of life for me and my family. This is what we do in Tarrant County and why in the last couple of years we have approved the requests to create units which focus on prosecuting intimate partner violence and to pursue those who prey on our children and older adults.

If the state is so adamant about voting on revenue increases over 2.5% then why not do the same for the state when the Comptroller estimates their tax revenues are going to exceed 2.5%? They can lower their sales tax rate just as we can lower our property tax rate. Then we can become a Libertarian from of government and strangle our efforts to keep Texas the great place to live and raise our families.

I do believe we have an opportunity to discuss the balance between property and sales taxes. There are decisions which can be made to shift dollars between these categories. The state’s revenue comes primarily from sales taxes while counties and schools from property taxes. So as the state continues to increase their reliance on property taxes via unfunded mandates and their formulas to fund public education, it will continue to shift the burden from the state to you and me as property tax payers. We should talk more about how the state can pay their fair share of public education and their mandates to reduce property taxes.

I am tired of the rhetoric put out by Empower Texans and their followers and you should be too. When Texas became a Republic, its leaders recognized that because of the size and diversity of the state, they needed local governments closest to the people to make decisions on how to best implement the laws they passed. It is time for elected officials to work together as we have in the past and keep Texas the great state it is as we approach our bicentennial.