| Good morning,

There is no denying that Texas’ system of property taxation is broken and in need of serious reform; the House and Senate measures to reform the property tax system must be adopted. Yet Texans are right now drowning in property tax burdens; they are in desperate need of actual relief today. Here is the Texas Minute. |

| – Michael Quinn Sullivan

|

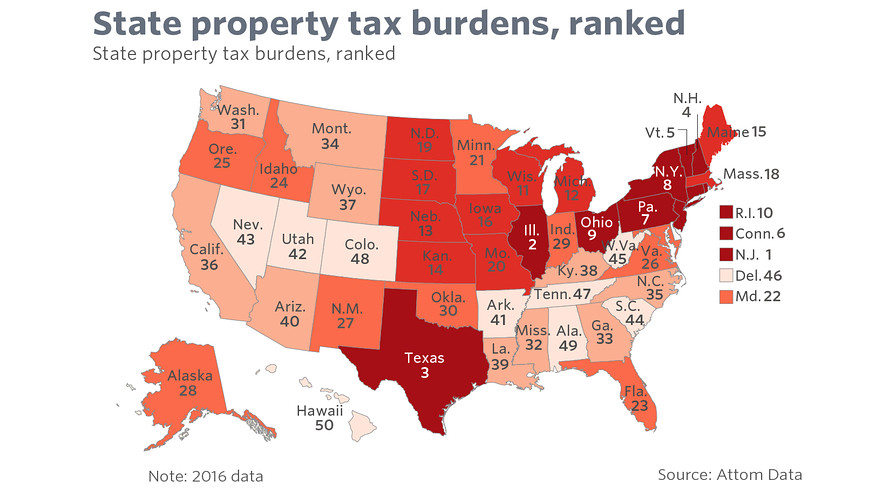

| · All property taxes are levied locally. Your property tax burden is set by those councils, boards, and commissions that 90 percent of Texas voters ignore at election time. · House Bill 2 and Senate Bill 2 as proposed would require local voter approval for an annual tax hike of 2.5% or more. While the bill applies to all school district taxes, it does not currently protect all Texans from city and county tax hikes. It excludes from protection many taxpayers living in suburban, “bedroom,” and rural communities. · Sign our petition demanding a strong limit on property taxes for ALL Texans! · Every single Texan should have the ability to directly control their property tax burden, not just people in large urban areas. · Remember: HB2/SB2 does not cut local taxing entities’ budgets. It simply requires local voter approval for tax hikes of 2.5 percent or more. The reform would still allow local officials to raise tax burdens 2.49 percent without voter approval, on top of collecting additional property and other tax revenue derived from growth. · More than $56 billion in property taxes was levied in 2016, with 53 percent of it being levied by school districts. That’s approximately $2,000 from each man, woman, and child in Texas. · “Past attempts by the Legislature to provide relief to property taxpayers by increasing the homestead exemption or by increasing other taxes have failed.” – Texas Public Policy Foundation · Reviewing records from the U.S. Census Bureau and the Texas Comptroller, the Texas Public Policy Foundation has noted that property tax burdens rose much faster than personal income growth from 1996 to 2016. · The Tax Foundation has consistently ranked Texas as having one of the worst property tax systems in the nation for businesses. · And in the Tax Foundation’s most recent study, the state had the nation’s 6th highest property tax burden. · “The cost of ownership is putting homeownership out of reach for young people.” – State Sen. Paul Bettencourt (R-Houston) · “I’m not going to be able to keep my house at this rate.” – Michael Openshaw, noting his property tax burden has increased $2,000 in six years. |

| · The legislature should adopt the Texas Public Policy Foundation’s plan to abolish the “Robin Hood” school maintenance and operations tax. It limits the growth of state and local government, and uses surplus dollars to eliminate the tax. · Let your lawmakers know you want to repeal the Robin Hood tax! · Enjoying the Texas Minute? Get your friends to subscribe by sending them to https://texasscorecard.com/subscription/. If you get someone to put your email address – editor@localnewsonly.com – into the “How did you learn about us” box, we’ll send you one of our cool, limited-edition Texas Cannon stickers suitable for any bumper featuring a Texas license plate. If you get five people to do it, we’ll send you a coffee mug. |