February 26, 2018

In addition to the February 20 article on LNO, concerning State Rep. Capriglione’s involvement with a $30 MILLION DOLLAR transaction with the O’Bama Administration; the paperwork uncovered shows that Capriglione was much more than an “authorized representative” for Pacesetter CDE!

Click on O’Bama Image Below to see 499 pages,

including Rep. Capriglione’s ownership interest!!! Click Below to See Armin Mazani Point out Specifics of the doc.

February 20, 2018 Southlake, Texas

Editorial Nelson Thibodeaux

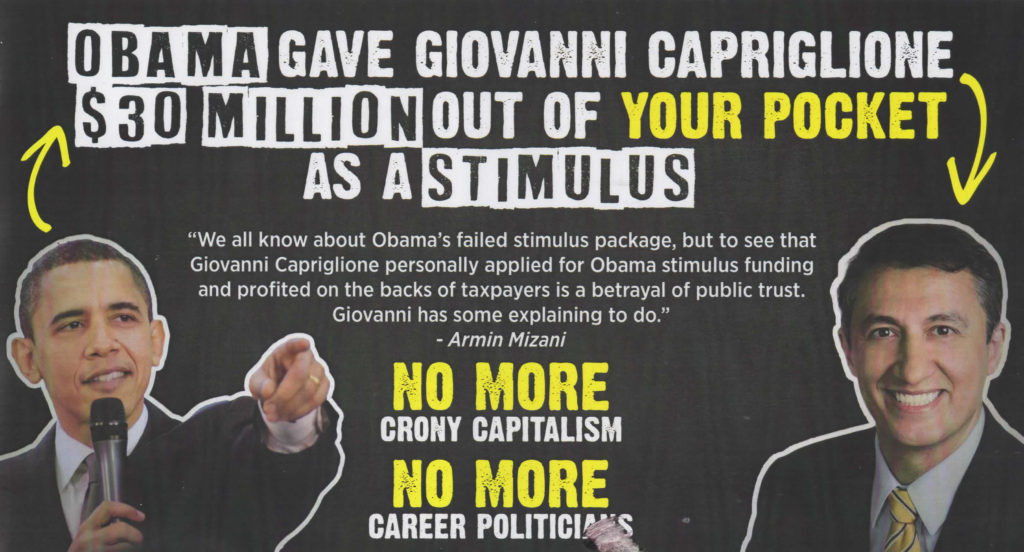

This Campaign Mailer has created questions, such as, did Representative Giovanni Capriglione Profit from Obama’s $30,000,000 stimulus? The answer is NO, well not as much as many other companies that got on the $1,555,000,000 gravy train. Yes ONE BILLION, FIVE HUNDRED, AND FIFTY FIVE MILLION DOLLARS!

The FIRST, “without a serious doubt” evidence is that Giovanni Capriglione was the original recipient of the original Department of Treasury letter signed in June, 2008.

Assuming of course that Giovanni was paid as the “Authorized Rep” to sign papers with the Government, as shown below in the link to “Letter from Govt to Giovanni Capriglione,”

Further as listed his participation as, “Governing Partner”, as well on 9 Texas LLCs related to these funds, one would speculate the Representative has or anticipates making profits out of the LLCs.

In fact, there are a total of 39 LLCs and one corporation listed in Texas all with the name of Mark Disalvo, as a principle.

Below is a letter that resulted in funds being paid to Pacesetter CDE, Inc. and Capriglione signing as the “authorized representative,” on behalf of the Company Pacesetters, Inc.

owned by Semaphore, Inc. located in North Andover, MA.

This was to inform the US Department of Treasury the “additional “Subsidiaries Allocatees” were being added.

Note that Giovanni Capriglione was listed on the first nine LLC filing until April 30, 2013; he was no longer listed on any of the LLCs and won the General Election in 2014.

The original document to receive the funds is signed by Giovanni Capriglione PRIOR to his election in 2014 for his first term. The document, including, Capriglione’s signature, can be seen here:Letter from Govt to Giovanni Capriglione .

All the LLCs, were registered in Texas as shown below;

April, 1, 2008 : Pacesetter CDE, INC is registered in Texas

June 2, 2009; These “new” entities join others that were previously filed, including on 6/25/2009: Pacesetter CDE, I LLC, II, LLC, III, LLC, IV LLC,

February 2012, the following were formed, Pacesetter CDE, V, VI, VII.

April 13, 2013, These include Pacesetter CDE IX LLC, X LLC, XI LLC, XII LLC, XIII LLC, XIV LLC, and XV, LLC. All of which were formed as Texas LLCs, on the same date April 30, 2013, modifying the official government instrument.

April 13, 2015, These filings included Pacesetter CDE LLC; XXX, XXXI, XXXXIII, XXXIV, XXXV, XXXVI, XXXVII, XXXVIII.

Note; LNO will be requesting an overview of how funds have been spent in Capriglione’s Authorized Representative status from the Federal Government via FOIA.

Pacesetter Texas Filing: 2013 Pacesetter filing: Pacesetter Texas filing 2013

Pacesetter CDC, Inc. Texas Filing: 2015 Pacesetter filing: 2015 Pacesetter filing

It appears that “beyond a serious doubt” is the best that investigative reporting can accomplish at this point. There is a major problem when the government doles out $1.55 Billion Dollars of Taxpayers monies to private entities, but we as taxpayers cannot file Open Records request to see where, how and whom the money was shared.

So at minimum there are serious questions of where is the $30,000,000 “signed off” by Capriglione. Further, I don’t believe that Capriglione is an attorney, so exactly what fees would he be due for signing this document.

As a Representative of House District 98, we call on Rep. Capriglione to make a FULL DISCLOSURE on these taxpayers funds, including what, if any, restitution or profits he has received as a part of the company and/or LLCs. That is a simple enough request that this could be furnished before the March election; that is unless the Representative has a reason not to disclose his financial winnings from the O’Bama package.

LNO is continuing to ask questions regarding this matter; LNO has contacted Congress Kenny Marchant’s office for a potential “Congressional Inquiry” how is it $1.55 billion dollars of taxpayers money is given to private companies, yet the taxpayers cannot see the final distribution?

Below is the original News Release from 2009 with monetary grants Below BLUE represents Pacesetter CDE, Inc. in Texas.

Treasury Awards $1.5 Billion Through Recovery Act to Encourage Private Sector Investments in Communities Around the Country

Awards Announced Under New Markets Tax Credit Program

Boston, MA – Just 100 days since the President signed into law the American Recovery and Reinvestment Act (Recovery Act), Treasury Secretary Tim Geithner today announced $1.5 billion in New Markets Tax Credit (NMTC) awards for 32 organizations throughout the country. With resources made possible through the Recovery Act, the NMTC Program injects private-sector capital investment into communities around the country to create jobs, stimulate economic growth, and jumpstart the lending necessary for financial stability. The awardees announced today are planning investments in renewable energy projects, charter schools, health care facilities, manufacturing companies and retail centers.

“The Recovery Act was a crucial step toward restoring economic growth, getting Americans back to work, and strengthening our nation’s financial stability” said Secretary Geithner. “Many communities have been left with a shortfall of financial support and are unable to pursue desperately needed projects, leaving residents to fall even further behind. The New Markets Tax Credit program helps break that cycle by providing an incentive to invest in communities to break ground on new projects, create jobs, and offer much needed services.”

The 32 organizations receiving awards have identified principal service areas covering 33 states, the District of Columbia, and Puerto Rico. The NMTC Program, established by Congress in December 2000, permits individual and corporate taxpayers to receive a credit against federal income taxes for making qualified equity investments in investment vehicles known as Community Development Entities (CDEs). The credit provided to the investor totals 39 percent of the cost of the investment and is claimed over a seven-year period. A majority of the taxpayer’s investment must in turn be used by the CDE to make qualified investments in low-income communities.

Secretary Geithner’s announcement was made today at Project Hope, a New Markets Tax Credit award recipient in Boston, MA. Secretary Geithner was joined by Massachusetts Governor Duval Patrick and Community Development Financial Institutions (CDFI) Fund Director Donna Gambrell. A division of the Department of Treasury, the CDFI Fund, administers the NMTC program.

“We are here today at Project Hope because it’s a shining example of how the New Markets Tax Credit can be utilized to transform communities and improve the quality of life for the local residents,” said CDFI Fund Director Donna J. Gambrell. “Through $4.8 million in New Markets Tax Credit financing, the center we are gathered at today is providing expanded adult education, job placement and career development services and is also Roxbury’s first certified green building.”

To date, close to $12 billion of private-sector capital has been invested through the NMTC Program into urban and rural communities throughout the country. Data reported through 2007 shows that $9 billion dollars of NMTC capital has been invested into approximately 2,000 businesses and real estate developments – helping to develop or rehabilitate over 68 million square feet of real estate, create 210,000 construction jobs, and create or maintain 45,000 full time equivalent jobs at businesses in low-income communities.

A complete list of the 32 organizations selected and additional information on the NMTC Program can be found on the CDFI Fund’s web site at: www.cdfifund.gov.

2008 NMTC Program Recovery Act Awards

- List of Allocations

- Overview of Allocations

- States Served

- Profiles of Allocatees

| Name of Allocatee | Headquarters | Service Area | Predominant Market | Allocated Amount |

|---|---|---|---|---|

| AHC Community Development, LLC | Cleveland, OH | National | CA, DC, FL, IL, NV, NM, VA | $55,000,000 |

| Albina Equity Fund, I LLC | Portland, OR | State-wide | OR | $10,000,000 |

| Bethany Square LLC | Santa Monica, CA | Local | CA | $10,000,000 |

| California Urban Investment Fund, LLC | Oakland, CA | Local | CA | $20,000,000 |

| Capital One Community Renewal Fund, LLC | McLean, VA | Multi-State | LA, MS, TX, NY, NJ | $90,000,000 |

| Capital Trust Agency Community Development Entity, LLC | Gulf Breeze, FL | State-wide | FL | $75,000,000 |

| Capmark Community Development Fund LLC | Denver, CO | Nation-wide | CA, CO, FL, KY, LA, MI, TX | $85,000,000 |

| Carver Community Development Corporation | New York, NY | Multi-State | NJ, NY | $65,000,000 |

| CCG Community Partners, LLC | Princeton, NJ | National | CA, FL, LA, MO, NJ, NC, TX | $20,000,000 |

| Charter Facilities Funding, LLC | Denver, CO | National | AZ, CA, CO, NY, NC, OR, TX | $20,000,000 |

| Chase New Markets Corporation | New York, NY | National | AZ, IL, MI, NJ, NY, OH, TX | $85,000,000 |

| Commercial & Industrial Community Development Enterprise , LLC | Norwalk, CT | National | AR, CA, GA, ME, MS, MT, OR | $85,000,000 |

| Community Development Funding, LLC | Columbia, MD | National | LA, MD, MS, NY, PA, PR, WA | $20,000,000 |

| Empire State New Market Corporation | New York, NY | State-wide | NY | $30,000,000 |

| Enterprise Corporation of the Delta | Jackson, MS | Multi-State | AR, LA, MS, TN | $20,000,000 |

| ESIC New Markets Partners LP | Columbia, MD | National | CA, FL, GA, KY, LA, MS, NY | $95,000,000 |

| Harbor Bankshares Corporation | Baltimore, MD | Local | MD | $50,000,000 |

| Heartland Renaissance Fund, LLC | Little Rock, AR | State-wide | AR | $55,000,000 |

| Kitsap County NMTC Facilitators I, LLC | Silverdale, WA | State-wide | WA | $20,000,000 |

| MetaMarkets OK, LLC | Oklahoma City, OK | State-wide | OK | $25,000,000 |

| NCB Capital Impact | Arlington, VA | National | CA, DC, MA, MI, NY, OH, TX | $90,000,000 |

| New Markets Redevelopment LLC | Oklahoma City, OK | Local | OK | $50,000,000 |

| Northeast Ohio Development Fund, LLC | Cleveland, OH | Local | OH | $30,000,000 |

| Opportunity Fund (formerly Lenders for Community Development) | San Jose, CA | Local | CA | $35,000,000 |

| Pacesetter CDE INC | Richardson, TX | State-wide | TX | $30,000,000 |

| Rockland Trust Community Development Corporation | Rockland, MA | Multi-state | MA, RI | $50,000,000 |

| SBK New Markets Fund, Inc. | Chicago, IL | Multi-state | IL, MI, OH | $35,000,000 |

| Solomon Hess Loan Fund, LLC | McLean, VA | National | CA, FL, IL, MI, NJ, NY, TX | $50,000,000 |

| Synovus/CB&T Community Reinvestment, LLC | Columbus, GA | National | AL, AK, DC, GA, MA, NY, TX | $50,000,000 |

| Urban Development Fund, LLC | Chicago, IL | National | AL, CA, FL, IL, LA, MS, TX | $65,000,000 |

| Vermont Rural Ventures, Inc. | Burlington, VT | State-wide | VT | $30,000,000 |

| Wayne County – Detroit CDE | Detroit, MI | Local | MI | $50,000,000 |